CRA Rep A Client - chg my return missing today - why?

It was there last week.

T1 Enquiry has a 30 minute wait.

Does anyone have any news about this?

Still there for me as of a minute ago.

@Arliss

Is this accessible via Rep A Client for client returns.

Where do I find the prompt now?

Maybe I am tired and just can’t see it for looking.

You can change the current year return right in the “Overview” section; there should be a big blue button that says “Change My Return”

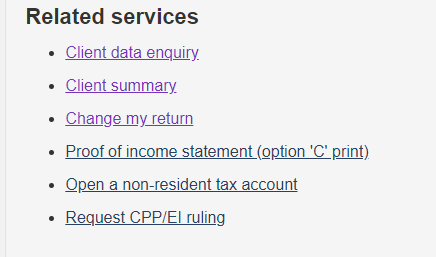

You can change prior year returns by going to “Client Summary” in the “Related Services” section, clicking on a Return, scrolling down to the bottom and selecting “Change this Return”.

Perhaps the blue “Change My Return” buttons glitched when you logged in or didn’t load properly in your browser.

@Arliss

Thank you for the screen clip. In this particular case I wanted to adjust T1 2010 and T1 2011 before paper filing T1 2012, 2013, 2014 and eFiling 2015, 2016, 2017, 2018. For rescue tax clients I find it easier to start with oldest return first. Then I have a clear picture of how all the assessments will end up when all returns are filed. I will check again after eFiling the years that I can eFile. I am authorized as a level 2 with online access.

It seems that I need to have at least the last three years filed and assessed before the CHANGE MY RETURN button appears.

There is no Change My Return button under the assessments.

There is no Change My Return button under the Related Services.

I did not know about a “3 year rule” before being able to change a return online, but I suppose you have researched the issue or CRA confirmed that was why you are not able to make a change yet.

I paper filed and efiled a bunch of old T1’s for a student in late November and just checked on the 2011 return. They were all assessed fairly quickly (even the paper returns). The 2018 was also re-assessed automatically to update the client’s RRSP limit. It seems that I would be able to change the 2011 return if I wished, as the second screenshot below is of the 2011 T1.

Mystery Solved!

I tested several scenarios and this is what I found:-

-

Change My Return is currently (as of 2020-01-08) available for assessed tax years 2012 to 2018. It is not available for tax years 2010 or 2011. These years must be paper filed with a letter or a T1Adj.

-

If you have used the Change My Return feature then your tax return is marked as Reassessment in Progress. This status bars you from using the Change My Return feature FOR ALL TAX YEARS until the “reassessment in progress” is update to assessed. In my experience you need to wait until the assessment is finalized, ie on or after the new NOA date.

BACKGROUND - Through Client Summary and eNOA we can preview the assessment before the new NOA days or weeks before the assessment date. In CRA terms the assessment is “FINALIZED” effective the assessment date. -

If you have paper filed a T1 Return then your tax year is marked as “RECEIVED” until it is passed to an assessor. Then the received return status is updated as “IN PROGRESS” until the assessor completes their work. Then the return is updated to “ASSESSED”. The assessed status appears after the assessor has completed their work and before the check, deposit, liability, and/or Notice of Assessment is finalized. Having a RECEIVED return noted to your file DOES NOT prevent you from using the CHANGE MY RETURN function. However you need to wait until the Assessment Date until you can access the CHANGE MY RETURN function again.

-

If you paper file a T1Adj, then your submission is stacked until logged. So no status update appears until the T1Adj is logged. In the past this was done just prior to hand over to the assessor. So you may not see any status change to “in progress” for weeks or months after submission.

ARGH this is so technical and every changing, without any clear communication from CRA. I have to put on my Miss Marple hat to test and learn how things work in the trenches. This is ok and interesting some times. Not so much during crunch and busy times.