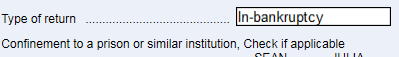

When I select this

I still need to manually select

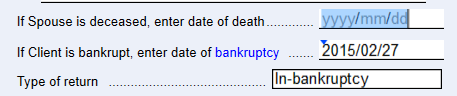

Has a date (in 2015 or 2016) for bankruptcy been entered in field directly above the type of return field ? This would be part of the condition to activate the field for exclusion on the EFILE Worksheet.

~ Rob

No, this person went bankrupt a couple of years ago and the trustee filed the first return so the date would not be 2015 or 2016.

For some reason, the trustee has refused to file any returns for this individual while he is in bankruptcy; therefore, since I complete his wife’s return , I am filing his as well. He is on the extended payment plan so he has not been discharged so as far as I am concerned, he is just in bankruptcy and changing the drop down should be enough to make it efile ineligible.

CRA still has him coded as bankrupt so the date should not matter.

We will look at revising the condition around this to have it set the field on the Efile Worksheet.

~ Rob