I thought it was CRA policy to not adjust cpp and ei on t4’s but rather file a pd24 form, is it common practice to file the adjusted slips as program calculates?

Well, Walt, you can do it the way CRA says you should, and cost the taxpayer hours of civil servant labour,

or you can do it the expedient way…

Your choice…

but, ultimately, same result.

Thank you Bert

I was curious as to how most are handling this, we started with the Tax Cycle adjustments last year. I haven’t received any feedback from CRA and have to assume this is acceptable.

Walt

I received a notification from cra asking to verify the clients information for CPP.

Your issue is different than the original posting

sorry i think i was missing critical information from my original post. I received a letter from CRA to verify a clients information employees information. what happened was the software automatically changed the cpp amount to zero and put the difference in income tax amount.

Thanks

I see what you are talking about.

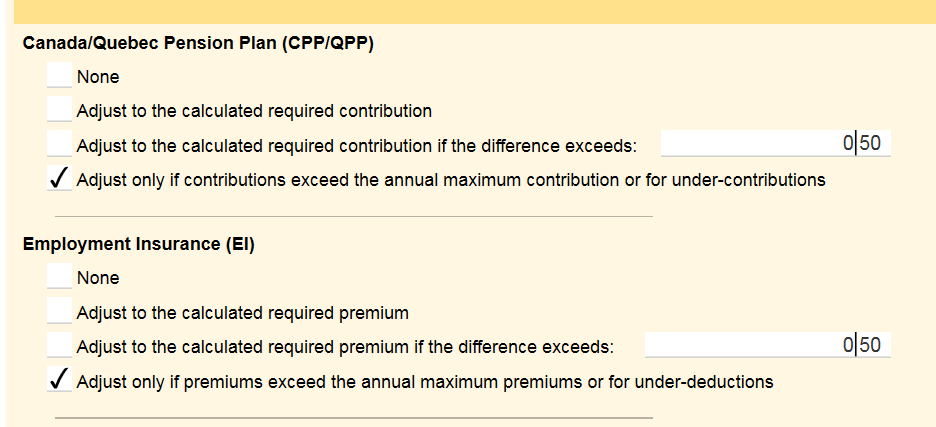

Unfortunately, the adjustments that Taxcycle will complete are setup by the user so you have your settings incorrect in that file. Go to the T4adjustment options and check your settings.

I suspect that the individual in question likely has earnings under $3500 and you have selected adjust to calculated required contribution selected in the file.

I only adjust for contributions over/ under the annual maximum.

It would be better if the 2016 program modified this screen as follows:

Would it be possible to give us a call at Taxcycle so that we can investigate this further.

1-888-841-3040