Can someone simplify new authorization process?

Significant Changes to CRA’s Authorization Processes Starting in February 2020

Authorization-Processes-Nov-28-2019-EN-Final(1).pdf (704.7 KB)

Received this from CRA

Thanks for posting this, Helga! Excellent reference.

Also, we posted this news item this morning: https://www.taxcycle.com/News/T1013-form-discontinued-this-year-but-you-can-still-transmit-authorization-requests-from-TaxCycle

It is not as detailed as @helga_spence’s document, but hopefully clarifies how TaxCycle fits into this process.

It is not clear for me: how do I get online access for my new clients?

until February you use the t1013 after that there will be a new process that will come out for online filing.

And in TaxCycle, you will be able to transmit that authorization using a worksheet that is very similar to the T1013 form once the system is working again.

Note that we are currently aware of an issue with transmissions that the CRA is investigating: https://www.taxcycle.com/News/Issues-transmitting-T1013-requests

@gresillas

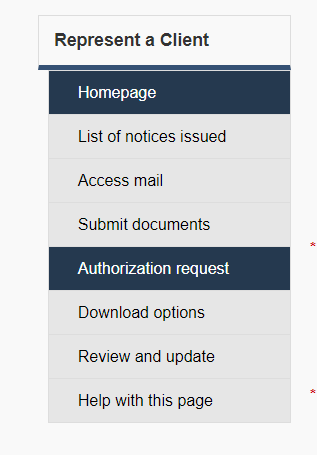

Just in case you were asking about business access, it hasn’t changed - log in to Represent a Client, then:

- Click Authorization request

- Select your name or business and click [Submit]

- Click Add authorization request

- Fill in the details of the form and click [Next]. If CRA can’t verify the Owner name (which is quite likely), just select “New owner”

- Specify the level of authorization you want and click [Next]

- Specify which accounts you want access to and click [Next]

- Check the box to confirm the information entered and click [Submit]

- Print the page displayed and get the client to sign it.

- Scan the signed authorization page, and upload it to CRA using the “Submit Documents” feature.

From what CRA is saying, I suspect they are replacing the T1013 process with something similar to the above.

Thank you

[Mailtrack](https://mailtrack.io?utm_source=gmail&utm_medium=signature&utm_campaign=signaturevirality5&)

20-01-11, 06:27:59 p.m.Does anybody know if the T1013 transmission issue has been resolved?

Just tried to transmit one using TaxCycle and got the following error: “The software used to prepare this file was not certified. Please contact your software developer to obtain the certified version of the software.”

I successfully filed on on Jan 10 after I had issues and was told it was systemic.

Not certain but you likely need to use the T1013 in the 2018 module.

I was so hopeful with your tips to use the 2018 version, but I got the same “software not certified” error again when efiling it from a 2018 T1.

Thanks,