I am new to Taxcycle. I see that the US exchange rate is automatically filled in on the T5008 but the proceeds do not seem to be converted to Canadian $. Is there something I have to do to have it convert?

Once you enter the amount and the exchange rate is there, it should be converted to Canadian total in the total field.

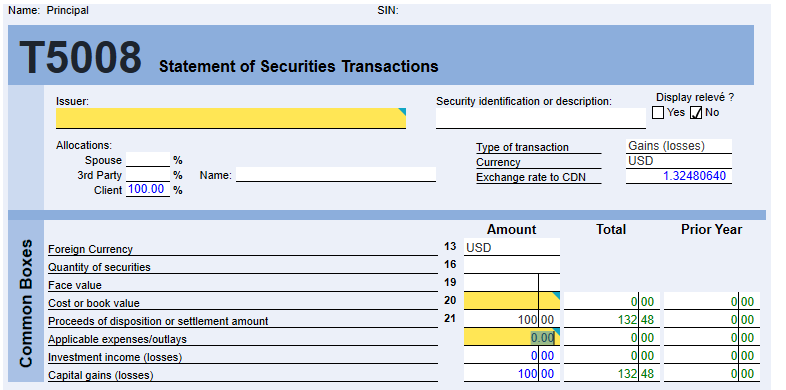

Make sure you enter the currency as USD.

The proceeds are $100 USD and an exchange of 1.3248. If you look at the total column, the income earned is 132.48

so it appears to be working

How do you apply the different exchange rate when you put in the ACB?

At the moment, the program is not setup to do that.

You would need to do some math to convert the ACB to the current year exchange rate so when it does the calculation, it puts the proper amount in the total column.

@Cameron could add this to the suggestion list to have another Exchange rate to Canadian that affects line 20 only.

Recommendations:

- Warning on Exchange rate applied for disposition (Schedule 3,

Schedule 3 Manager, T5008) that an exchange rate may be different for the

ACB and Outlays. - Ability to change the exchange rate on the ACB

- Ability to change the exchange rate on the Outlay

OR… Once an Exchange Rate is applied, the ability to flip the T5008 over

to the Schedule 3 Manager and/or force the slip over to the S3Manager.

Where can I enter an exchange rate for the ACB?

You cannot enter the exchange rate for the ACB at the moment. Adjust your ACB amount so it provides the proper ACB when multiplied by the exchange rate entered into the program.

Or

Override it.

Thank you. I guess the easiest way is to calculate manually and override it as ACB can be from any year.

Now that we can add the buy and sell exchange rates, could we please get BOTH in the slip summary?