Schedule J, Part B - Why are lines 50, 52, 54 and 56 not totaled on line 74? I have to override to get the total in there.

Hi Tim,

The total should calculate when the taxpayer and/or the spouse is eligible for the credit.

Eligibility

Your client may be entitled to a refundable tax credit for expenses related to home-support services if he/she meets both of the following conditions:

• Your client was resident in Québec on December 31, 2017.

• Your client was at least 70 years of age on December 31, 2017.

If your client had a spouse on December 31, 2017, and he/she is also entitled to the tax credit, only

one of them can claim the credit for the couple.

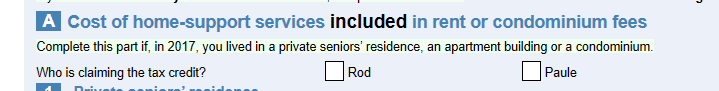

In TaxCycle we validate the above eligibility to claim the credit in order to calculate the total. We also check to see who you chose to claim the credit. In a coupled file you will see the following on the form:

Let me know if that doesn’t do the trick.

~ Annie

But does not that question only apply to Part A and not to Part B?

This is for housekeeping services in a home. As per the Part B instructions, “Complete this part if, in 2017, you lived in your own house…” Right in the guide, page 83 of TP-1-G, states, “If you lived in your own house throughout the year, go directly to Part B of Schedule J.” You don’t complete the who is claiming the credit section.

Hi Tim,

You are correct in saying that part B is for the Cost of home-support services not included

in rent or condominium fees. That said, the taxpayer still needs to meet the QC residency and age criteria to be eligible to claim that portion of the credit. And the credit can only be claimed by one person in a couple situation.

The who is claiming the credit question is something we added to the form to facilitate the choosing of who should claim the credit for the couple. Maybe we should have placed it in a different section in the form instead of in part A which can create confusion as it applies to all parts. Moving it higher closer to the statement check boxes might be better… what do you think?

Thanks Tim!

~ Annie

If you are trying to determine who is (or even should) claim the credit and it applies to the entire form, I think that the selection should be near the top of the entire form, if not even at the top. Otherwise, it will be assumed that the selection is only for a part of the form.

Thank you Tim!

I will make that change.

~ Annie