TaxCycle has the T2091 Principal Residence Designation form but I can’t find the T1255 Principal Residence Designation for a Deceased Individual. Is this form missing in TaxCycle or am I looking in the wrong place?

We presently don’t have this form in any of our module’s. We have it on our list as a form for potential inclusion to TaxCycle if we continue to hear multiple requests for it’s inclusion.

~ Rob

OK. My biggest concern was that if it was in the program, I needed help finding it. Filling in the T2091 and manually transferring the information to the T1255 is a workaround for paper filed returns but can be time consuming.

I put in my vote to include the T1255 as soon as you can, especially for efile eligible returns.

if it is a form required to efile, it should be there regardless of the requests for the said form.

I vote for the request to have this form added

Hi All,

Thanks for the feedback asking for inclusion of the T1255, the form has been added in to the T1 module - look for it in our next release.

~ Rob

There doesn’t seem to be anything triggering the program in the T1 Module to create the T1255 form. We tested it in our office making sure to fill in a deceased date of death, the representative information, checked that the princpal residence is sold, completed the bottom of the S3 and then a prompt to create form shows 2091/1255 but when you right click, at the top it only shows the 2091. Is there a way to code it that if the date of death and the principal residence is selected then the program directs you directly to create the T1255?

04 March 2019 version:

Clear message in Taxcycle comes up:

“Enter the details of the principal residence(s) that the client disposed of during the year. Create the T2091 (of T1255 if the client is deceased) using the QuickFix in the message on the field entitled “T2091/T1255 form used to report this disposition” below. Then review the T2091/T1255 and complete the form as required.”

Taxcycle populates both forms - the Tax Preparer simply needs to choose the correct one.

Hopefully the person operating the keyboard can trigger choosing the correct one between the two?

As far as I can see, it seems quite straightforward as it currently is…

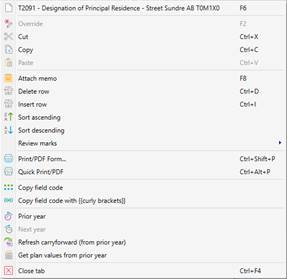

We have the latest version in our office. This is what I see. The “Create a new” is all one button and it doesn’t matter where I click! And as you can see, I am only provided with the T2091 at the top of the list. J

![]()

Teena Johnsson | Accounting Technician

P: 403.638.3116 | F: 403.638.9166 | Box 1963 | #201, 101-6th Street S.W. | Sundre, AB | T0M 1X0

www.valbpc.com

Access Sharefile our client web portal for secure file sharing

Chartered Professional Accountants Help You Make Better Decisions

Hi Teena.

This is an interesting problem you have. I created a sample tax return and didn’t fill in the deceased date or any information relating to death. I checked the sale of principal residence box and filled in the principal residence sale information on S3. I then pressed F4 and was able to open both the T1255 and the T2091 and both were populated with the sale details.

I think what Teena is saying is that while in the Schedule 3, if you right click the only option available is to jump to the T2091 and not the T1255. You can see this in the image she attached.

To be quite honest, I’ve never used the right click in this area. I have both the T2091 and T1255 saved on my “Forms Bar” and always access them directly from there… likewise with the T2125, T2042, T776, Motor Vehicle etc.

Also, as @harlen says, a quick F4 then T1255 gets you there too.

I also confirm that TaxCycle does properly populate the T1255 with data if the individual is deceased.

Thank you so much for your example! I will give those steps a go! A helping hand is always appreciated!

Wonderful! Thanks for your help!