I always found it strange that Taxcycle prints an instalment schedule on the client letter and includes March 15th when March 15 has clearly past. This is mainly an issue when clients weren’t required to pay instalments the prior year. I get a call on this almost every time clients panicking that they missed the March 15th deadline. Does anyone have a fix for this? I usually just tell them to ignore my letter and wait for CRA to send them an instalment request.

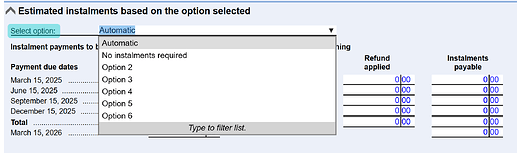

The instalment information in the client letter comes from the bottom portion of the Instalment Worksheet. You can make changes there

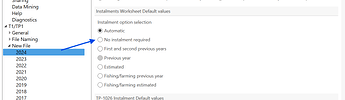

Or you can set the default to No instalment required in your Options.

Thanks @sarka . What if instalments are required but it’s past March 15th?

I think what you are looking for is on this page. Where this is the first year that instalments apply, the client will generally only get an August instalment reminder since the current year (2024) tax return is typically filed after the February instalment reminders have already been sent out for the March 15 and June 15 instalment due dates. See the section under “If you received an August reminder only” on this page.

The instalment worksheet is a tool to facilitate cashflow and tax planning with your client where it may be beneficial to make payments that are different than what CRA will calculate based on Option 2 in the worksheet.

Because the client letter includes the March 15, 2025 tax instalment, I have quite a few clients who overpay their taxes to the CRA. Does anyone know if the CRA will apply this excess amount to any future liabilities or issue a refund to the clients? I know the clients request a refund of overpayment if there is no outstanding balance. I would like to know what action the CRA will take if the taxpayer does not contact the CRA.

Thanks Sarka, what I find - perhaps because for many years interest rates were so low - is that instalments payments in general, and this input form in particular was often ignored by tax preparers. You, the preparer can make it much more meaningful by actually review it in light of the particular taxpayer, and also actually indicating if a March 15 instalment has been made.

And you should also fee free to adjust the client letter to your firm’s preferences. My instalment instructions read: “Your instalment requirements total $6,717. Please remit payments to the CRA according to this schedule. Please note that the payments noted for next year March 15 are for 2026 taxes:”

In general CRA will allocate any payments made after January 1 to the current year instalment account, no matter what you specify when you make the payment.