I am new to TaxCycle and I would like to know how we flag the tip income in TaxCycle as being included in CPP calculations on the CPT30.

Thanks!

Sorry, not what I was asking. I know where the tips go on the T4. You can add tips to income and contribute to CPP. How do we get the tips to show up in income on the CPT30.

Thanks!

it is CPT20 that you need for one it will help with filling in info

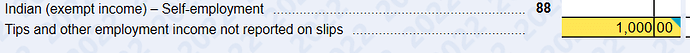

It’s not line 88 as noted by @lmanleytax. If you enter the unreported tips on the line BELOW line 88 (see below), TaxCycle will prompt you to enter the appropriate info on CPT20 (yellow boxes and messages):

If the tips are not related to an existing T4 slip, you can create a new T4 slip “page” to enter just that number. Or, you can manually enter the details on CPT20.

Interesting that this works! I’ve never used it before…probably because most people would rather not report their “unreported” tips at all. (If the employer knows about the tips, they would be included in box 14 already, with the appropriate amount of CPP deducted, if applicable.)

sorry, yes the CPT20.

How do you do it on the CPT20?