I am trying to fill out the S8RECWS and I need to add the fact that there is a 10.1 asset included that costs more than what is allowed for tax purposes so I can reconcile the difference. I tried entering the difference on under Other Adjustments in the portion of the T2 adjustments but it indicates that I am over riding the field. Is there somewhere else I should be entering, if so where?

Kristi,

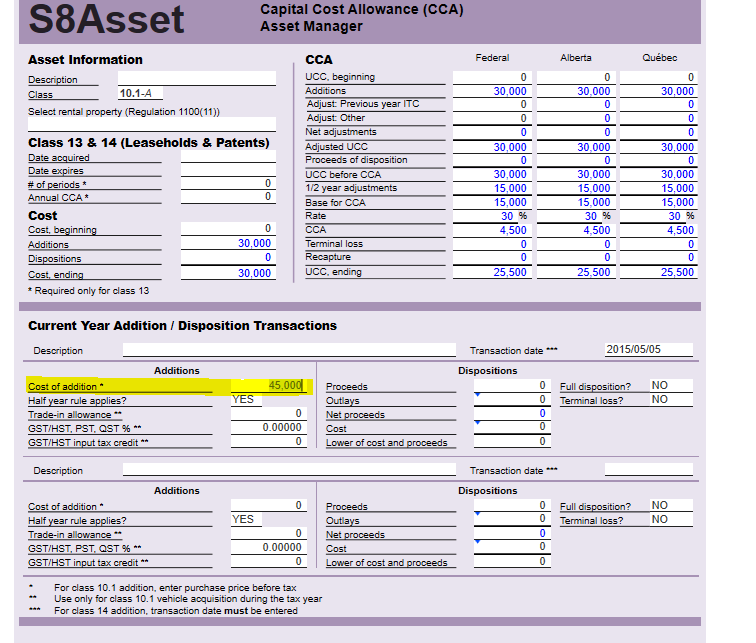

If your asset is a current year addtion, TaxCycle will calculate the difference when your enter the transaction details in the S8Asset worksheet. In the following example, the 15 000$ will flow automatically to S8RECWS.

Let me know if that works for you.

~Stéphanie

1 Like

Thank you Stephanie. Apparently I didn’t understand how to fill in S8Asset properly. I was putting the $30,000 where you have the $45,000.