Working on a final T2 (up to date of dissolution)

- SH forgive corp $12k (unpaid SH loan balance)

- CORP will pay $4.2k for professional fees

Accounting:

JE:

Debit Shareholder loan $12,000

Credit Other income - Debt forgiveness $12,000

Tax:

- $12,000 - Other Revenue GIFI 8230

STEPS ON T2

- Deduct $12,000 SCH 001

- Use non capital loss available under Section 80 (box 140) SCH 004: $5937

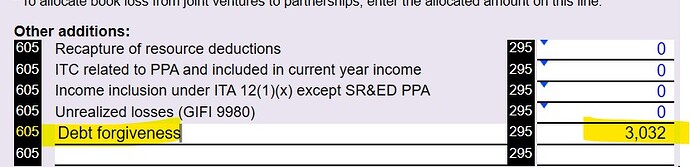

- Remaining forgiven amount multiplied by 50% and added to SCH 001

Calculation:

Debt Forgiven: $12,000 - Non-capital losses from PY: $5,937

=$6,063 x 50%

=$3,031.50

4. Claim insolvency deduction SCH 001

Net income (loss) for income tax purposes ($4,200.00)

Is this how others would handle this tax situation?